Today, investors face a dilemma. The global pandemic has completely disrupted markets. The S&P 500 is currently trading near its highest valuation levels since the dot-com crash of 2000. And treasury rates are near 0.Finding promising investments is harder than ever. Recently, Bloomberg asked investment experts where they’d personally invest $1,000,000 right now.

They overwhelmingly recommended alternatives, like art.

After all, the “0.1% of the 0.1%” have placed their bets on art for centuries. From the Rockefellers to today’s wealthiest titans—Jeff Bezos, Bill Gates, and Eric Schmidt all actively collect art. In fact, 61% of high net worth collectors allocate 10–50% of their overall portfolios to it. But despite the boom, very few actually know how to properly navigate the notoriously opaque art world, regardless of wealth.

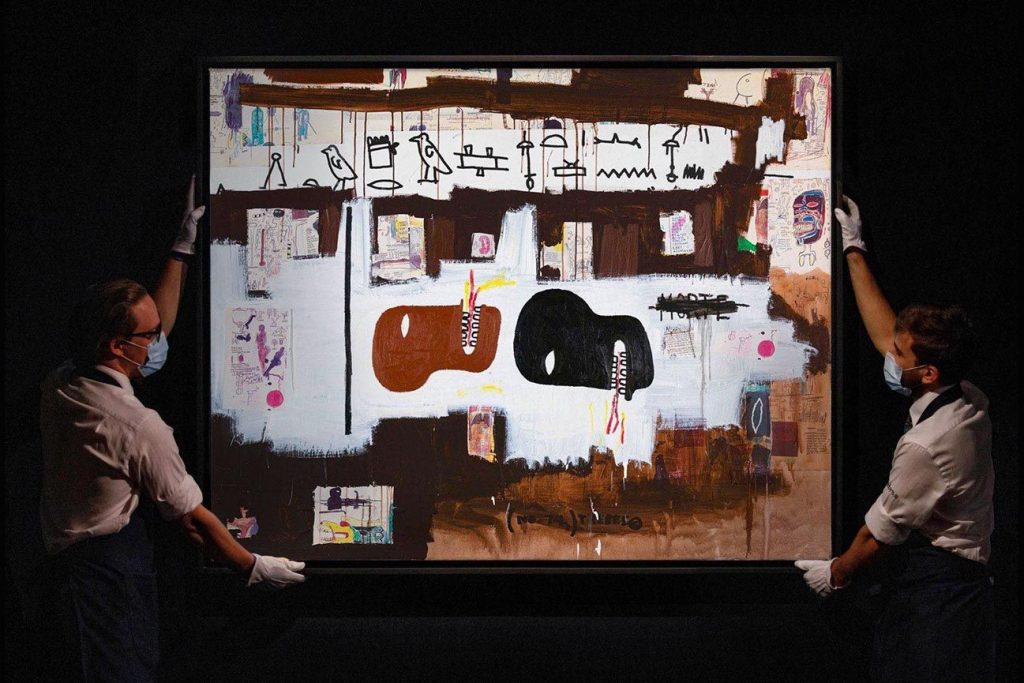

Artwork for All

Contemporary Art prices have outperformed S&P 500 returns by 174% from 1995–2020. That’s especially impressive when you consider the epic 20-year bull run we’ve just seen. Art as an asset class has also trounced other conventional “safety hedge” investments like gold and real estate. So, how can you add this resilient and lucrative investment to your portfolio? Normally, you would need tens, or even hundreds, of millions to build a properly diversified portfolio of art. But there’s a little-known… but incredibly smart way… for everyday people to invest in contemporary art at a fraction of the typical purchase point.

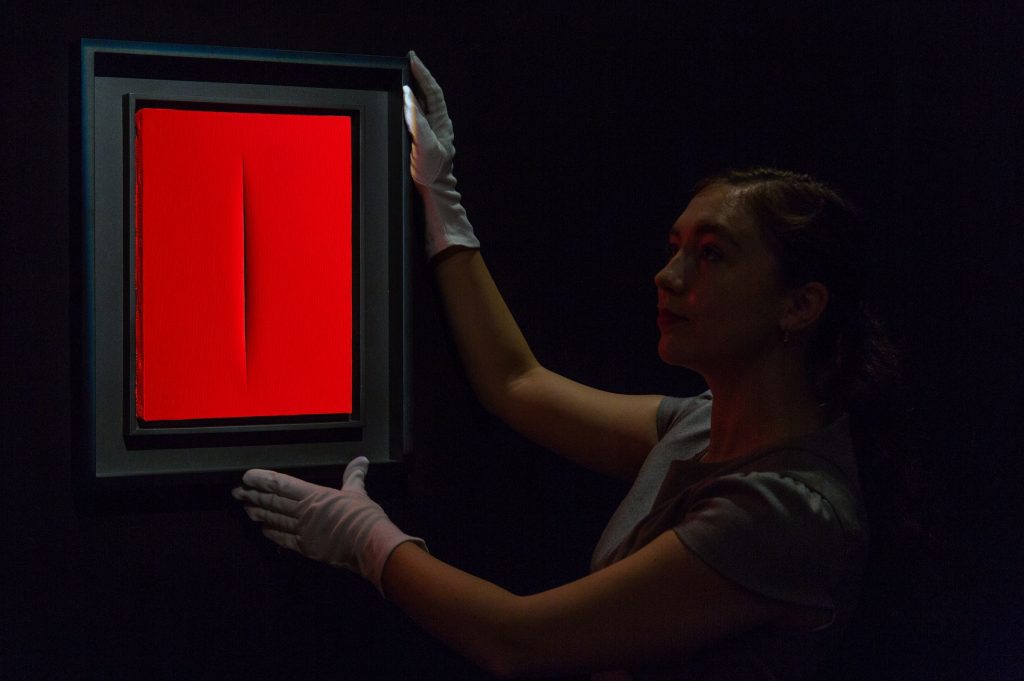

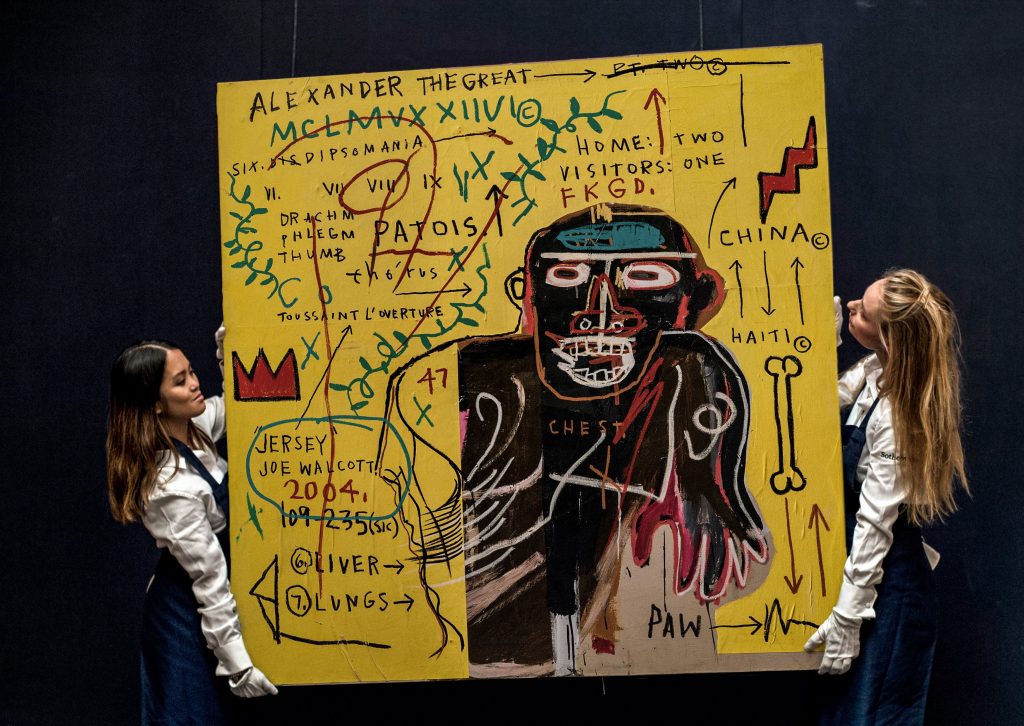

It’s all thanks to the recently enacted JOBS Act Title II that has opened the doors to this exciting $6 trillion asset class. Why does securitizing art make sense? For starters, the total wealth held in art and collectibles is projected to explode by another $1 trillion by 2026. On top of growth, there’s incredible potential for returns. In 1984, a Basquiat painting was sold for $19,000. In 2017, it fetched $110,500,000 at auction, resulting in a 5814% gross return on investment. With Masterworks, you can buy shares of multimillion-dollar paintings by legendary artists like Warhol, Money, and Basquiat. The very same types of paintings regularly hang in museums and on the walls of the most extravagant mansions.

Early adopters have already cashed in with a net annualized return of 32% in a year from a Banksy painting called ‘Mona Lisa, their first sale. That profit was twice the return from the S&P 500 over the same period. We partnered with Masterworks to give our readers priority access to their offerings. Use the link below to skip their waitlist and invest in multimillion-dollar paintings today.

See important disclosures HERE.

- iKamper Skycamp DLX Rooftop Tent - April 23, 2024

- 6 of our favourite men’s shirts for Summer from &SONS - April 23, 2024

- Spring Men’s Grooming Must-Haves from Happy Nuts - April 23, 2024